Is it time to break up the Euro?

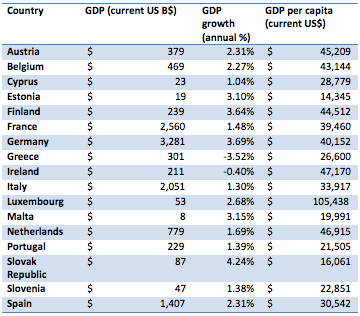

With Greece in the news constantly, we must ask ourselves, is it time to break the Euro? The US Dollar has long been the gold standard as the world’s reserve currency and the Euro was supposed to be its closest competitor. Euro is presently used by 17 counties as their exclusive currency and it encompasses over 326 million people. While it looks great on the surface one has to wonder how countries with such varying and different socio-economic environments were expected to live in harmony. Here is a snap shot of key economic data:

You are probably wondering why a country with an economy of $3.2T (Germany) is sharing the same currency as Estonia which has an economy of $19B. The difference in economic conditions is staggering. In addition we have 4 countries, France, Germany, Italy and Spain that represent over half of the total GDP figure. When we take it a step further there are countries with per capital GDP’s ranging from $105,538 (Luxembourg) to $14,345 (Estonia).

By all accounts countries such as Estonia have a long way to go before reaching the economic development of a country like Germany. The initial thought was that countries such as Estonia can reduce foreign currency exchange risk for investors. As a result investors only have to focus on investment specific risk and consider the merits of individual projects. While this is a great idea in practice, the fact of the matter is that countries such as France and Germany are the real source of power and influence of the Euro. Hence France and Germany drive almost all decision making in relation to the Euro. Germany for example is a well-developed economy and has the tendency to manage inflation (similar to Canada) by ensuring that the economy doesn’t get overheated. Therefore when the growth rate exceeds 3% they increase interest rates. The increased cost of borrowing reduces growth and more people move funds into T-Bills and other government investments. This in turn increases the value of the Euro in relation to other countries. I know what you are thinking, isn’t this a good thing? While it is great for Germany, Estonia needs exactly the opposite. Estonia for example needs to grow as much as possible and need to have lower interest rates and a cheaper currency to increase foreign investments. Since Estonia has little clout with the Euro, Germany’s interests will generally prevail.

How on earth did they expect to balance such differing interests? They we wonder why Greece is having problems at this time. Yes there was significant government mismanagement but without the ability to effectively manage currency, Greece has to act like a Germany. How is this possible when the per capital GDP of Greece is $26,600 and Germany’s is $40,152? We should break-up the Euro and only include countries with similar economic development.

Written by: Sam Perera, Financial Savant